n the fast-paced world of finance, the role of traders has been essential in driving market liquidity and facilitating transactions. However, recent trends have indicated a decline in trading activity, leading to concerns about the future of this crucial market function. This article explores the challenges and opportunities faced by traders in the ever-evolving financial landscape, shedding light on the factors that have contributed to the stagnation of a $4 trillion market.

The Changing Landscape of Trading

Rise of Algorithmic Trading

The advent of technology has revolutionized the trading landscape, giving birth to algorithmic trading. Algorithms, driven by complex mathematical models and high-speed computers, can execute trades with lightning speed and accuracy. This shift towards automation has significantly impacted traditional trading practices, as algorithms can analyze vast amounts of data and react to market conditions in real-time.

The introduction of technology has transformed the trading scene, giving rise to algorithmic trading. Algorithms, which are powered by complicated mathematical models and fast computers, can execute transactions at breakneck speed and precision. Because algorithms can examine massive quantities of data and respond to market situations in real time, this trend toward automation has had a profound influence on traditional trading techniques.

Impact of Regulatory Changes

Regulatory changes, particularly in the aftermath of the global financial crisis, have placed stricter requirements on traders and financial institutions. The implementation of regulations such as the Volcker Rule and MiFID II has limited proprietary trading and increased transparency in trading practices. These regulations aim to prevent excessive risk-taking and promote market stability, but they have also constrained the profitability of trading desks.

Challenges Faced by Traders

Reduced Market Volatility

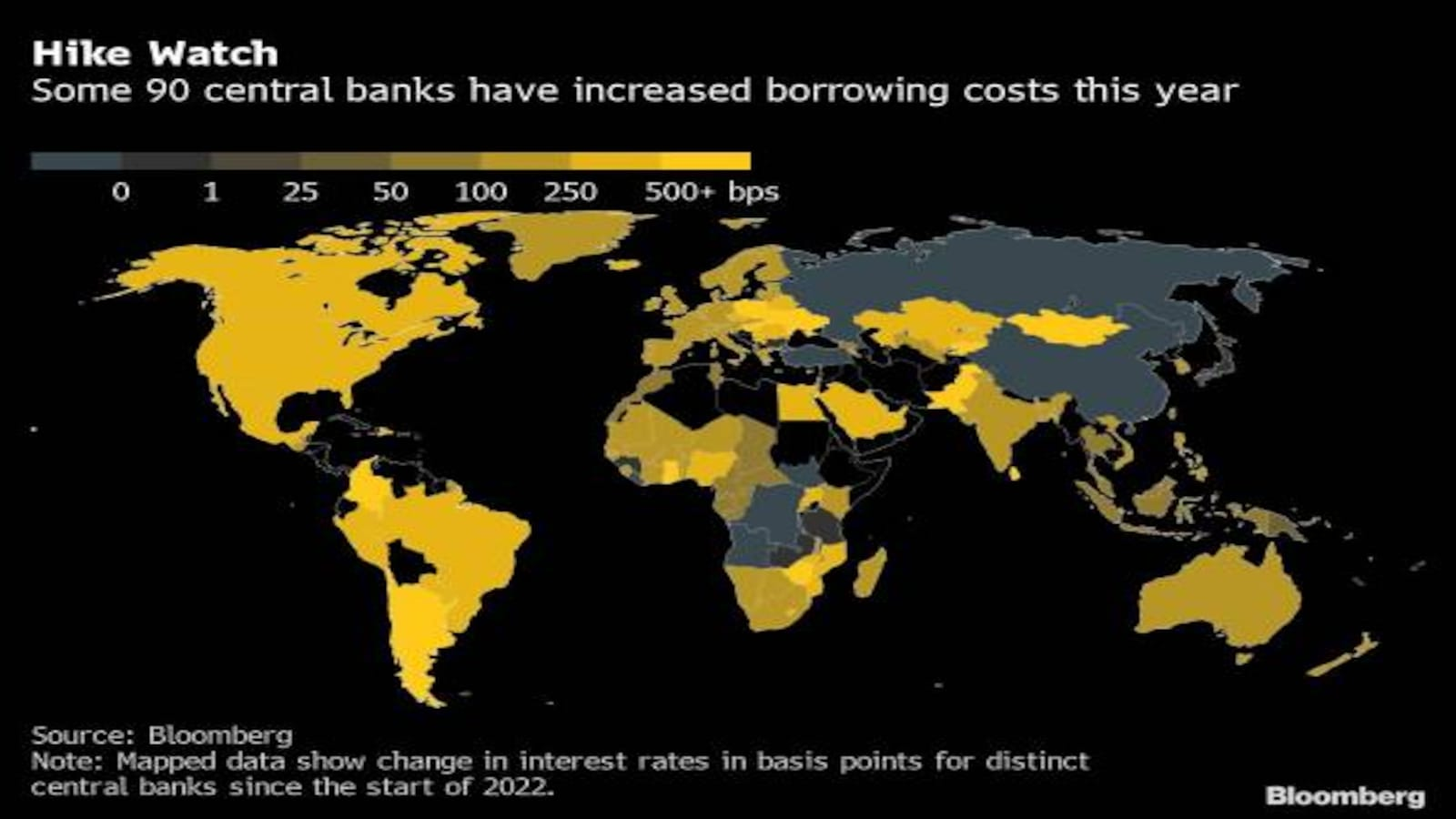

The decline in market volatility has been one of the major challenges for traders. Volatility is a measure of the magnitude of price fluctuations in the market, and it provides opportunities for traders to profit from price movements. However, in recent years, markets have experienced lower volatility due to various factors, including central bank interventions and geopolitical stability. This reduced volatility has limited the profit potential for traders who rely on short-term price fluctuations.

Fragmented Liquidity

The fragmentation of liquidity across multiple trading venues has made it increasingly difficult for traders to find counterparties and execute trades efficiently. With the proliferation of alternative trading systems and dark pools, liquidity is spread across various platforms, reducing the concentration of buyers and sellers in a single market. This fragmentation has led to thinner order books and wider bid-ask spreads, making it more challenging for traders to execute large orders without impacting market prices.

Risk Management and Compliance

The increased focus on risk management and compliance has added another layer of complexity for traders. With regulatory requirements becoming more stringent, traders are required to adhere to risk limits and compliance protocols, which may limit their ability to take on larger positions or engage in certain trading strategies. Additionally, the need for real-time monitoring and reporting of trades has increased the administrative burden on traders, diverting their attention from market analysis and trading decisions.

Opportunities in the Changing Landscape

Embracing Technology and Automation

While technology has disrupted traditional trading practices, it also presents opportunities for traders to adapt and thrive. By leveraging sophisticated trading platforms and algorithms, traders can enhance their decision-making process and execute trades more efficiently. The integration of artificial intelligence and machine learning algorithms can enable traders to analyze vast amounts of data and identify potential trading opportunities that may go unnoticed by human traders alone.

Expanding into New Asset Classes and Markets

As traditional markets face challenges, traders can explore new asset classes and markets to diversify their portfolios and capture new opportunities. Emerging markets, alternative investments such as cryptocurrencies, and niche sectors like renewable energy present untapped potential for traders willing to expand their horizons. By staying ahead of market trends and understanding the dynamics of these emerging sectors, traders can position themselves for long-term success.

Building Strong Relationships and Networks

In a world of automation, the value of human relationships and networks cannot be underestimated. Traders who cultivate strong relationships with clients, counterparties, and industry professionals can gain access to valuable market insights, potential trading opportunities, and collaborative partnerships. Building a robust network can help traders navigate through challenging market conditions and stay informed about market trends and developments.

Conclusion

The role of traders in the financial markets is undergoing a significant transformation. While challenges such as reduced market volatility and increased regulatory constraints persist, traders can embrace technological advancements, explore new asset classes, and build strong networks to adapt to the changing landscape. By staying agile and continuously evolving their trading strategies, traders can navigate the challenges and seize the opportunities that lie ahead in the $4 trillion market.